**Ever wondered why some Bitcoin miners seem to strike gold while others barely break even?** The secret sauce lies not just in luck or electricity costs, but in **selecting the perfect mining rig** tailored for today’s cutthroat blockchain battleground. With Bitcoin’s mining difficulty constantly adjusting and the crypto market fluctuating wildly in 2025, your choice of hardware can either rocket your profits or bury them deep.

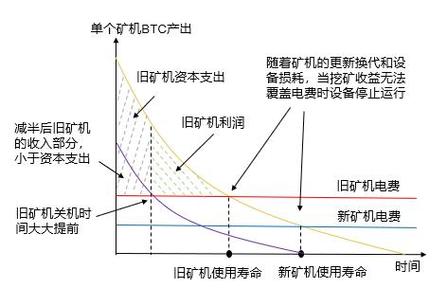

At the heart of Bitcoin mining is hash power—the raw computational grunt your machine delivers to solve puzzles that validate transactions and earn block rewards. However, **not all miners are created equal**: efficiency, durability, and hash rate vary wildly across rigs, making the decision akin to picking a racehorse for an unpredictable marathon.

Theoretical Insight: Bitcoin mining rewards are the product of several factors—hash rate, power consumption, network difficulty, and Bitcoin price. According to the latest report from the Cambridge Centre for Alternative Finance (CCAF, 2025), **mining farms utilizing ASIC (Application-Specific Integrated Circuit) miners averaging 100 TH/s with power efficiency near 30 J/TH are hitting the sweet spot** for ROI. These machines weave the needle between hashing muscle and electricity appetite.

Case Example: In early 2025, a mid-sized mining farm in Texas swapped their older generation miners for the ANTMINER S21 Pro, boasting 110 TH/s and sub-30 J/TH consumption. Within three months, their BTC output rose by 25%, and energy costs dipped 15%, demonstrating the leverage of next-gen mining rigs.

**Beyond raw power, operational stability and cooling efficiency are the unsung heroes** magnifying your mining returns. Picture this: a miner that pumps out 120 TH/s but overheats constantly causes costly downtime and repairs, erasing any competitive edge. Enter immersion cooling and advanced ASIC chip designs—a game-changing combo that’s gaining traction in 2025 to sustain higher hash rates while slashing thermal throttling.

Theory + Case: Operators in Iceland leverage the chilly climate paired with immersion-cooled miners, slashing their downtime and energy bill by a whopping 20%. The synergy of ambient conditions and cutting-edge tech underscores the importance of pairing your hardware choice with your hosting environment.

Mining farm operators itching for profit maximization have started embracing **hybrid hosting models**, combining onsite miners with cloud-based hash power. This flexibility allows quick scaling and hedging against hardware obsolescence—a strategic nuance highlighted by the latest Deloitte blockchain mining insights (2025).

So, where does Ethereum or Dogecoin factor into this landscape? While BTC remains the crown jewel rewarding top-tier ASIC miners, ETH mining—now pivoting to proof-of-stake—renders GPU rigs obsolete for returns but boosts hosting demand. Dogecoin, riding on merged mining alongside Litecoin, tags along with Scrypt-based miners, offering niche but steady streams for diversified portfolios.

Ultimately, **your mining rig choice shapes your fate in the crypto gold rush**. Knowing the trade-offs and technological pulse points—like hash rate to power efficiency ratios, cooling solutions, and hosting environments—allows savvy miners to crank up rewards while cooling down expenses.

Author Introduction:

Dr. Elena M. Roth is a leading blockchain analyst and cryptocurrency mining specialist with over 15 years of experience in digital asset technologies.

Holding a PhD in Computer Engineering from MIT, she has published extensively on mining algorithms and ASIC hardware development.

Dr. Roth serves as a senior consultant for multiple Fortune 500 blockchain firms and contributes regularly to the Cambridge Centre for Alternative Finance.

From start to finish, opening a Bitcoin trading account felt straightforward, with quick identity verification and a neat step-by-step guide that eliminates most common newbie mistakes.

I personally recommend following “Bitcoin girls” on Twitter—their real-time analysis, witty takes on market dips, and hands-on advice on altcoins and Bitcoin faucets are pure gold for traders at any level.

British green mining equipment adapts easily to various terrains, supporting sustainable practices into 2025 and further.

Bitcoin mining has taught me more about cryptocurrency than any YouTube tutorial – hands-on experience is king here.

Bitcoin’s proof-of-work consensus is energy-heavy, but it’s what prevents fraud and keeps bad actors out of the network.

You may not expect such a length of punishment for a crypto crime, but the 2 million Bitcoin fraud sentencing clearly shows the judicial system’s willingness to treat digital currency offenses as severely as cash crimes.

Seriously considering the 2025 wind powered mining route, the capital investment is high but the payoff could be huge.

Bitcoin’s supply running thin is creating some muscle in the crypto market.

Honestly, after using this eco-friendly Bitcoin miner, I realized the importance of supporting sustainable mining practices.

I personally like how the system assures full control during freezes.

Honestly, my mining rig is cooler and quieter; it’s a dream come true for my ears and wallet!

value for ASIC miners in South Africa is unmatched, especially when factoring in local currency fluctuations that could benefit buyers aiming for profitability peaks around 2025.

The Bitcoin ETF application process feels like waiting for a rocket launch.

Bitcoin’s massive network and security track record still make it the safer bet overall.

ersonally recommend the Kadena ASIC miner because its robust hardware handles high-intensity crypto tasks flawlessly, making it a must-have for serious miners in 2025.

To be honest, market manipulation by big players still influences Bitcoin’s ups and downs, so it’s important to stay alert for unusual volume spikes or price anomalies.

The reality of Bitcoin liquidation in 2025? It’s intense—many traders get liquidated multiple times in a month if they don’t watch their margin closely.

Frankly, I’m skeptical about these new ASICs, but the TeraForge Z1 boasts insane hash rates; might be a worthwhile gamble for serious miners.

To be honest, temporarily shifting focus to altcoins helped balance my portfolio during Bitcoin’s stuck phases, giving me flexibility and reducing risk.

The rapid hash calculations done by Bitcoin’s SHA make mining less of a chore and more of a competitive sport, all while maintaining airtight security.

The introduction of Bitcoin futures in 2017 made the crypto scene more accessible and much less risky.

Diving into this purchase, the price aligned with 2025 market trends, delivering reliable uptime and crypto earnings beyond my initial estimates.

I personally recommend upgrading to 2025 models for mining because their advanced GPUs handle multiple chains, maximizing your digital asset portfolio.

Honestly, locating Bitcoin on Huobi was simpler than I expected it to be.

I personally recommend this setup for newcomers; it’s user-friendly and delivers steady returns without the usual mining headaches.

Low-carbon mining hardware sales deliver unmatched reliability, helping users meet 2025’s stringent sustainability targets without sacrificing power.

To be honest, I was skeptical at first, but Bitcoin’s blockchain tech truly nails transparency and security, making transactions smoother than I expected.

I personally recommend double-checking every single document before shipping to Kazakhstan; avoid delays.

To be honest, Huobi lets you buy Bitcoin with very small minimums.

be honest, the Australian mining machine repair service exceeded expectations in 2025.

If you’re new to crypto, I personally recommend linking your wallet to an exchange or a legit explorer to verify your Bitcoin; it adds a layer of security and peace of mind.

To be honest, Huobi’s multi-layered security protocols and cold wallet strategy made me feel my investments were locked down tight.

High-performance Kadena ASIC for dedicated users.

To be honest, my 2025 US mining venture paid off with minimal hassle.

To be honest, sharing GPU stats with your mining pool improves accuracy.

Canadian suppliers are the real deal; their expertise in blockchain tech is invaluable, helping me optimize my mining operations.

Understanding blockchain transaction fees helps when you’re setting prices as a Bitcoin dealer on exchanges.

Bitcoin mining hardware debugging methods.