The year is 2024, and the hum of Bitcoin mining farms echoes across the American landscape, a testament to the burgeoning digital gold rush. But beyond the whirring fans and the flashing LEDs lies a complex world of finance, regulation, and, crucially, taxation. As we approach 2025, optimizing tax strategies is no longer optional for Bitcoin farms; it’s a survival imperative. These operations, often energy-intensive and capital-heavy, need every advantage they can get to navigate the ever-shifting sands of the cryptocurrency market.

The US tax code, a labyrinthine beast at the best of times, presents unique challenges and opportunities for Bitcoin miners. Understanding the classification of mined Bitcoin – is it inventory, a capital asset, or something else entirely? – is the first crucial step. The IRS hasn’t offered definitive guidance, leaving room for interpretation, and therefore, strategic planning. Aggressive yet defensible positions are key.

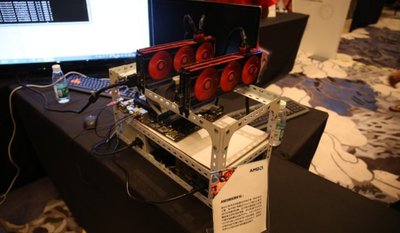

Depreciation is a powerful weapon in a Bitcoin farm’s arsenal. Mining rigs, servers, and other hardware can be depreciated over time, sheltering a significant portion of income. Bonus depreciation, a provision that allows for accelerated depreciation in the early years of an asset’s life, can provide an even more substantial upfront tax benefit. Consider also Section 179 expensing, which allows businesses to deduct the full purchase price of qualifying equipment in the year it’s placed in service, up to a certain limit. Careful planning and documentation are essential to maximize these deductions.

Energy costs represent a significant burden for most Bitcoin farms. Exploring renewable energy sources, such as solar or wind power, not only reduces the environmental impact but also unlocks valuable tax credits and incentives. The Investment Tax Credit (ITC) for solar energy, for example, can significantly offset the cost of installation. Furthermore, utilizing energy-efficient equipment and implementing smart energy management strategies can further reduce operating expenses and taxable income.

Location, location, location. The state and local tax landscape varies dramatically across the US. States with favorable tax climates for businesses, low electricity costs, and supportive regulatory environments can offer substantial cost savings. Consider the impact of sales tax on equipment purchases, property tax on real estate, and state income tax rates when choosing a location for your Bitcoin farm.

Beyond federal and state taxes, Bitcoin farms must also be mindful of self-employment taxes. Since mining activities are often considered a business, the income generated is subject to self-employment tax, in addition to regular income tax. Structuring the business as an S corporation or other pass-through entity can potentially reduce self-employment tax liability. Consulting with a qualified tax advisor is crucial to determine the optimal business structure.

Staying abreast of the ever-evolving regulatory landscape is paramount. New legislation and IRS guidance can have a significant impact on the tax treatment of cryptocurrencies and mining activities. Monitoring legislative developments and engaging with industry advocacy groups can help Bitcoin farms anticipate and adapt to changes in the tax code.

Accurate record-keeping is the foundation of any sound tax strategy. Maintaining detailed records of all income, expenses, asset purchases, and depreciation schedules is essential for supporting tax deductions and avoiding penalties. Utilizing accounting software specifically designed for cryptocurrency businesses can streamline the record-keeping process and ensure compliance.

Tax planning is not a one-time event; it’s an ongoing process. Regularly reviewing your tax situation, adjusting strategies as needed, and consulting with a qualified tax professional can help Bitcoin farms minimize their tax liability and maximize profitability. Proactive planning, rather than reactive compliance, is the key to claiming 2025 US tax advantages and securing a sustainable future in the competitive world of cryptocurrency mining.

The volatility inherent in the cryptocurrency market also presents tax-planning opportunities. For instance, carefully timing the sale of mined Bitcoin or other cryptocurrencies can help minimize capital gains taxes. Losses can be strategically harvested to offset gains, further reducing tax liability. A diversified portfolio and a disciplined approach to trading are essential components of a comprehensive tax-efficient strategy.

The future of Bitcoin mining in the US hinges not only on technological advancements and market trends but also on the ability of Bitcoin farms to navigate the complexities of the tax system. By embracing proactive tax planning, optimizing operational efficiency, and staying informed about regulatory changes, these businesses can position themselves for long-term success and profitability in the digital age.

This article unveils innovative tax tactics tailored for Bitcoin farms, blending legal frameworks with cost-cutting hacks. It explores evolving 2025 regulations, offering unexpected approaches that maximize deductions while safeguarding compliance in a volatile crypto landscape.